Whether it’s a first car, a first house or a first job, there is always a first. The same holds true for mergers and acquisitions. You will likely always remember your first M&A activity regardless of whether your company was the acquirer or the acquiree. You might, however, remember it more fondly if you were a part of the acquirer as often job losses can occur if you were part of the aquiree company. You will hear a number of terms tossed around that everyone in the room seems to understand. Below are a few of the basics that are part of most M&A activities.

Acquisition of Assets– also known as an asset sale- A merger

or consolidation in which an acquirer purchases the selling firm’s assets. The can purchase all of the assets or only a select few and are not required to accept the liabilities.

Acquisition of stock or a stock sale-A merger or consolidation in which an acquirer purchases the acquiree’s stock. This means they purchase all of the assets and all of the liabilities

Letter of intent or Agreement in Principle–An outline of the understanding between the two companies, including the price and the major terms.

Deal Structure–The nature of the fee paid by the acquiring entity in a merger transaction. Typical deal structure may include stock, cash or other valuable.

Due Diligence–In the process of an acquisition, the acquiring firm needs to see the target firm’s internal books as well as to audit their systems, processes and salaries. The acquiring firm does an internal audit. Offers are made contingent upon the findings of the due diligence process. Most due diligence processes go on for at least 90 days, but can last up to 6 months or more in complex situations

EBITDA–Earnings before interest, taxes, depreciation, and amortization.

Restructuring–This can be as simple as selling off an unprofitable or unwanted division or as complex as re-structuring the entire way the new entity does business and is branded. This is especially important when there is vertical or horizontal integration required.

Synergy–When the two companies are properly integrated and functioning, an output is achieved that is greater than the output obtained when the parts function independently

Human Resources should always play and important role up front in any due diligence process, as well as in the process of the actual merger of the two entities.

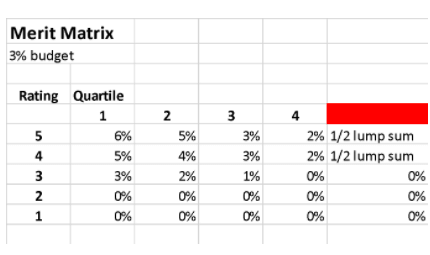

HR Financial Due Diligence– assessing HR financial risks, liabilities, and plan structures of compensation, benefits, and pension plans, workforce dynamics.

Human Capital Due Diligence assessing Human Capital aspects including culture, organizational structure, performance management, and workforce development approaches

Time spent up front will ensure that there are less unpleasant or unexpected surprises as the M&A activity draws to a close.